Top Trading Strategies: Master Support and Resistance Like a Pro

Chasing the Exact Bottom Can Get You Wrecked!

Hey there, trader! Buckle up, because I’m about to drop some mind-blowing wisdom that’s gonna get you hyped! We’re diving into why chasing that exact bottom is a total rookie trap and how pros crush it with killer trading strategies. Think of this as our little trading hangout—I’m pumped to share this with you, and by the end, you’ll be itching to master support and resistance like a boss. Let’s roll!

Index

Why Chasing the Bottom is a Trap

Alright, let’s kick this off with a truth bomb: hunting for that perfect bottom—thinking you’ve nailed the lowest price before a rocket ride up—is a trap! It’s like trying to catch a falling knife with your bare hands. Retail traders get lured in by the thrill, but pros? They know better. Today, I’m showing you how to ditch that newbie mindset and trade with the big dogs. We’re diving deep into trading strategies that actually work, and trust me, you’re gonna love this!

Meet Your Trading Crew: George, Warren, and Stefan

Picture three traders in the wild world of markets: George, our eager newbie; Warren Buffett, the sly market shark; and Stefan, our seasoned pro. First up, George—he’s all heart but zero chill. He sees a green candle and dives in, then spots a red one and bolts. Poor guy’s bleeding cash every time, and here’s the kicker: the markets don’t just hand out wins to the impulsive! If you want profits, you’ve got to outsmart the average Joe—like George—who keeps losing his stack.

Next, meet Warren Buffett—not the real one, but our crafty stand-in for market makers. This guy’s got the game locked down. He nudges prices to trick rookies like George into buying high, then unloads his stash when they’re desperate to sell. It’s the classic pro move—buy low, sell high, and let George’s enthusiasm fuel the profits. He’s always one step ahead, turning rookie mistakes into his gains.

Market Makers: The Real Puppet Masters

Then there’s Stefan, our trading hero. He’s calm, sharp, and doesn’t flinch at market noise. Stefan watches George stumble, tracks Warren’s slick plays, and jumps in when the timing’s perfect. No auto-trading nonsense for him—he knows that’s a fast way to lose it all to the Buffetts. Stick with me, and I’ll show you how to trade like Stefan—smart, steady, and winning!

Support and Resistance 101: The Pro Way

So, let’s get into it—support and resistance are where the magic happens! This isn’t about random lines on a chart; it’s about decoding market dynamics. Sorry, George, you’re our cautionary tale here! He’s losing over and over, handing his gains to the Buffetts, while Stefan’s got his eyes on the sharks, ready to strike when they target George. Warren’s strategy? Simple: bait the rookies, then cash in. Stefan’s trick? Figure out who’s driving the price—retail traders or market makers. If it’s just rookies like George, don’t expect big moves.

Now, let’s zoom into Stefan’s world—he’s all about spotting market makers. He’s watching every tick, every shift, because he knows their plan: trap retail traders, then liquidate them. It’s a chase, and Stefan’s always ahead. His whole game is pinpointing who’s in control. If it’s just retail, the price won’t move much—liquidity in trading is too thin. But when market makers step in, they shake things up, and Stefan waits for George to load up before pouncing as the Buffetts swoop in.

Chainlink Case Study: Breaking Down the Phases

Let’s break it down with Chainlink (LINK)—it’s a perfect example! The market cycles through phases: markup, distribution, markdown, and accumulation. Each one’s a chance to see this in action. When you’re hunting support and resistance levels, here’s the pro tip: stick to the weekly charts. Lower timeframes hide the big picture—daily gives you a feel, but weekly shows the real story.

Why weekly? It’s your go-to for clarity. Start with the daily to spot trends—say, a few green candles holding a level—then zoom out to the weekly to confirm. You’ll see price hitting certain zones over and over, with short liquidity stacking above and long liquidity below. That’s retail traders like George piling in during accumulation, hoping to nail the bottom. Then market makers tweak the price back into that zone, stirring the pot—it’s your chance to time it right!

Once accumulation ends, it’s go time: expansion, markup, and distribution kick in. Prices climb, retail traders jump in with bids, and buying pressure builds fast. Everyone’s hyped to push it higher, but here’s the catch—if it can’t break resistance, short liquidity piles up above that level. The price stalls, and for sharp traders like us, that’s a signal: watch the momentum and get ready to act.

When that resistance finally cracks, it’s a chain reaction—positions close, liquidity clears, and the market shifts. Want more on this? Christo’s got an awesome Discord stream on spotting liquidity in trading—total goldmine for leveling up! Now, about Chainlink’s support line: tread carefully at these lows. If you’re using leverage here, you’re with the retail crowd, building a liquidity pool below that market makers can’t wait to grab.

Retail traders see Chainlink holding above the 0.618 Fibonacci after a big move—perfect candle closes, steady volume—and FOMO hits hard. “This is the bottom!” they shout, going long with leverage, betting on a rally. Take George—he’s all in every time it dips to his “sweet spot,” dreaming of an “amazing, beautiful” entry. He plans to slide his stop-loss to breakeven once it ticks up, convinced a resistance break means a surefire win. But here’s the truth, buddy: confidence is great, but the market doesn’t care—it moves how it moves!

Spot vs. Leverage: Timing Like a Champ

Let’s get pumped because we’re diving into the good stuff—spot trading versus leverage! I’m stoked to break this down with you—it’s where sharp trading strategies can totally level up your game. When you’re going for spot positions, you’re zeroed in on those candle closes and how the price structure shifts. The trick? Catch that breakdown right when it happens. Here’s the deal: aim to bid at the bottom of the accumulation phase. That’s when the daily chart’s showing tight ranges and low volume—your perfect entry before the price takes off!

Now, here’s the twist: if the price starts slipping below that level, don’t sweat it—it’s a setup! It’ll often climb back up a bit, test a higher point—like a recent peak on the 4-hour chart—then reject and head lower. That’s your signal to act! You can look to exit your position on the retrace.

Switching gears to leverage—things get wild here! Stop losses are your go-to tool, but they can flip on you fast. Say you’re long at a support level, and a small wick dips below—bam, your stop triggers a market buy order, and you’re out. Market makers are watching this closely—they’ve got eyes everywhere! Imagine they want $100 million worth of Chainlink. They can’t just snap it up at once; the order book would push the price way up. Instead, they wait for retail traders—think hundreds of Georges on 100x leverage—to stack that long liquidity.

These retail folks are buying little by little, building a juicy liquidity pool below support. Their stop losses cluster just under the line, and as buying pressure grows, the price might spike up briefly. But market makers? They’re smart—they hold off until that liquidity’s ready, then step in to grab it cheap when stops get hit. It’s a pro move you can learn to spot!

As traders, we’re on high alert for shock supply signals. Don’t bid yet—it’s too early! Let retail traders pile in first. Look at Chainlink from May 2022 to March 2023—holding it was brutal. Even buying at a support sweep near the 0.382 Fibonacci left you down 60%. Why? Market makers triggered a supply shock, shaking out the crowd. You’d hear, “Chainlink is dead!”—total FUD—but it was their plan to push retail into selling and spark FOMO in the die-hards.

Those retail traders hanging on? They hit their limit. “I got in at $15, now it’s $6—time to cut my losses,” they say, dumping their bags. That selling pressure piles up fast, creating a supply shock. Prices can’t break resistance, fear takes over, and sentiment sours. Then—boom—a big candle closes above the 200-day EMA, media buzz starts, and interest picks back up. But hold up—the cycle’s not done! Price retraces, rejects that EMA, and drops again. Leveraged traders with stops below support? Gone in a flash.

Pros don’t jump in here—no clear direction, just noise. When price dips below support, ask: is it breaking, or grabbing liquidity? Look at the daily: if short positions stack up—sellers jumping in below—the pressure’s building. The smart trader waits for a solid move—like a close above support with volume—to make their play.

Retail traders like George? They’re in for some tough moments. Picture being down 70%, sweating, thinking, “I’ve got to sell!” Panic selling kicks in, perpetual contract holders get liquidated—millions in orders vanish—and fear rules. This is when market makers pounce, scooping up big positions—say, $100 million worth—without spiking the price, thanks to all that selling pressure they’ve set up. You market sell? They’re buying it right up.

Here’s how it goes: hundreds of Georges, each with a few thousand bucks on 100x leverage, get liquidated. That’s massive selling volume hitting the market. Add spot holders who’ve been underwater forever, finally giving up, and it’s a market maker’s dream. They load up while chaos reigns. Your move? Don’t panic—watch the daily for liquidation spikes, check the weekly for support strength, and wait for the pros to signal the trend.

Next, let’s unpack the price structure—it’s a classic pattern! You’ll see lower highs and lower lows, with the odd fake-out high to keep you guessing. Market makers might push a higher low, then drop it to sweep liquidity below, adding more selling pressure. When prices dip under those lows, retail traders fuel a liquidity pool that market makers tap without spending big. They nudge prices lower, grabbing that liquidity in trading, then bounce it back up—fortifying support with their activity.

Prices might sit below the 21 EMA for weeks, showing a slow build-up. A reclaim of the 21 EMA? That’s a structure shift—time to ask: are we losing a level or gaining one? Is it higher highs and lows, or just retail chop? Pros won’t let prices hang here long—they’ll drive them up, shaking out weak hands. A clear dip below support, a shift, and a reclaim are your signs they’re in control. That’s when support becomes a launchpad for big moves!

Patience is everything in accumulation—don’t rush in! If you’re holding, wait for an upside shift or a market maker signal. Prices sweep liquidity, climb, and retail sentiment flips—whales step back in, selling to eager buyers. Those quick V-shaped recoveries? Rare. It’s usually accumulation, markup, distribution, markdown, then repeat. Christo’s ‘Bang Bang Strategy’ on Discord nails this—focus on higher timeframes for the real action. Lower timeframes? You’ll miss the big picture.

Don’t be George, fighting the market solo. Be Stefan—follow the market makers. If support holds, someone’s buying; if it breaks, they’re gone. Assuming it’ll hold because it did before? That’s a trap! Watch who’s driving, where liquidity flows, and when market makers move—liquidity taken, prices rising, that’s your setup. Spot a sweep, a shift, and a reclaim of support, and you’re ready—set stop losses and targets to stay ahead!

🐋 Swim with the Whales

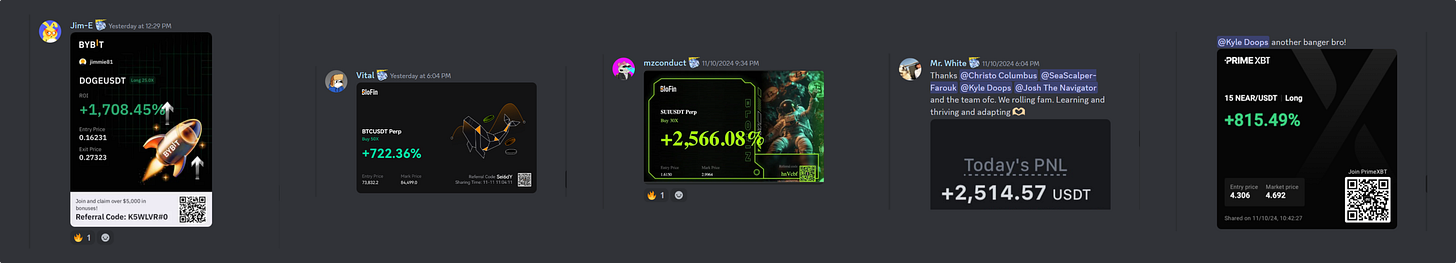

Let’s get pumped and peek into the Whale Room—where precision meets huge profits! Our crew’s killing it with top-notch trading strategies, and I’m buzzing to share how they owned the market last week. This is the team you need!

Farouk the Sea-Scalper rules fast trades! He turned a SWELL scalp into a wild 2,458% gain—insane, right? His PICO scalp on WIF hit 18%, with PEPE, APE, and COW soaring 161%, 60%, and 84%. Farouk’s moves are electric—proof quick wins are real!

Christo Columbus nails golden gains. He caught Arweave’s 30% dip for a 52% win by Friday, rocked Grok at 763%, and scored 320% on PEPE, 260% on APE. His leveraged account’s 100% on point—NEAR at 350%, ATOM at 234%, RENDER at 900%, and COTI at 100%. Christo’s a legend at balanced, big payoffs!

Josh the Navigator’s a chart wizard. He grabbed 218% on BRETT, with KAS, INJ, and RENDER delivering steady wins. Quiet but killer, Josh guides you to profits!

🚀 Ready to Jump In?

Want in on this action? Join the Whale Room today and snag the hottest trade calls around! Don’t miss out—this crew’s thriving, and you can learn to trade like a pro with us. Let’s make some serious gains together!

📈 Next Trade: Sundog Still in Play!

New week, new wins! Farouk’s eyeing Sundog, and it’s shaping up as the Whale Room’s top pick. Looking for a solid setup? Keep Sundog on your radar—it’s got breakout vibes. Farouk says, “Sundog’s got my attention—solid potential. I’m watching the Monday range, but it’s looking strong.” With him on it, this could be the trade to kick things off with a bang—stay tuned in the Whale Room for real-time updates!

⭐️ Whale Stories

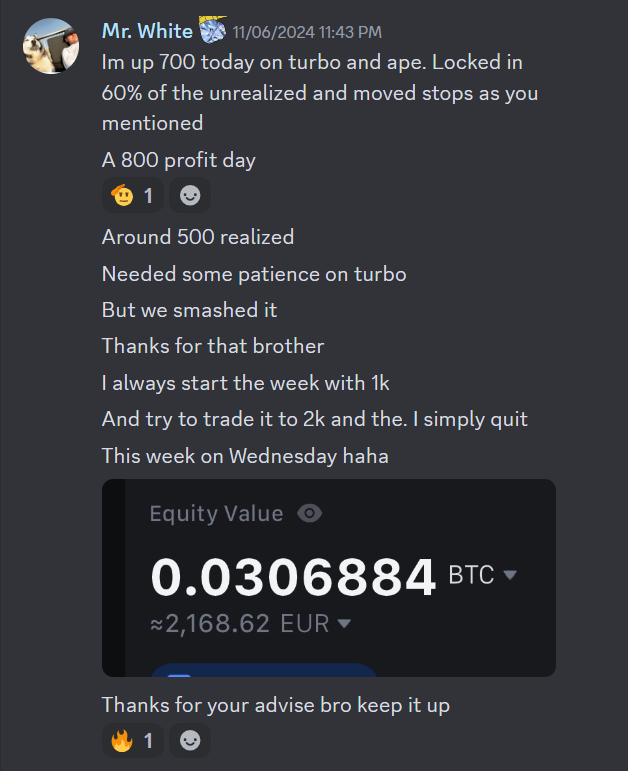

Curious what it’s like inside? Check out Mr. White’s take:

That’s the Whale Room vibe—killer support and resistance tips and a crew that helps you nail consistent gains. Ready to feel it yourself? Dive in and join the party!

🔥Conclusion

Mastering support and resistance isn’t just drawing lines—it’s about understanding price psychology, how market makers move, and positioning yourself smartly. Pros get this, avoiding retail traps to grab the edge in a tough market. It’s not about snap reactions—it’s disciplined timing, smart entries, and knowing the dynamics cold. Whether you’re chasing steady wins or building long-term, these skills are must-haves. Want to turn that into real results? The Whale Room’s your next step!

Over to You

When the market tests support, what’s your go-to signal for a solid base? Drop it in the comments—I’m all ears! Loved this? Shoot it to a friend via email and spread the hype.

Ready to tackle support and resistance like a pro? Join the Whale Room—our exclusive insights keep you steady through market twists. Don’t fall into traps—our team guides you on every level, entry, and exit. Sign up now and take charge of your trades! Join the Whale Room here.

Chat soon,

Inet Kemp