Hey crypto enthusiasts! Ready to turn your trading dreams into reality? Buckle up because we're diving deep into the thrilling world of spot trading on Bitget - where every trade is an adventure waiting to happen!

Index:

What's Spot Trading?

Think of spot trading as your personal crypto treasure hunt - you're buying actual digital gold (okay, crypto) at one price and selling it when the price is juicier! It's like playing the world's most exciting market game, but with real stakes and real wins. Read more here on why Bitget is one of the leading platforms in the crypto trading space.

Your Adventure Map: Getting Started 🗺️

Level 1: Join the Crypto Party - Create an account

Create your Bitget account faster than you can say "To the moon!"

Complete your KYC - think of it as your VIP pass to the crypto world

Level 2: Power Up Your Wallet

Load up your account with crypto firepower! Choose your weapon:

USDT (the trader's best friend)

BTC (the OG crypto)

ETH (the smart contract king)

USDC (another stable buddy)

If you want to deposit FIAT, read more on how to do it here.

Level 3: Master Your Trading Dashboard

Your control center is packed with cool features:

Trading View charts (your crystal ball into price movements)

Order book (red for sellers, green for buyers - like a crypto traffic light!)

Price alerts (your personal crypto watchdog)

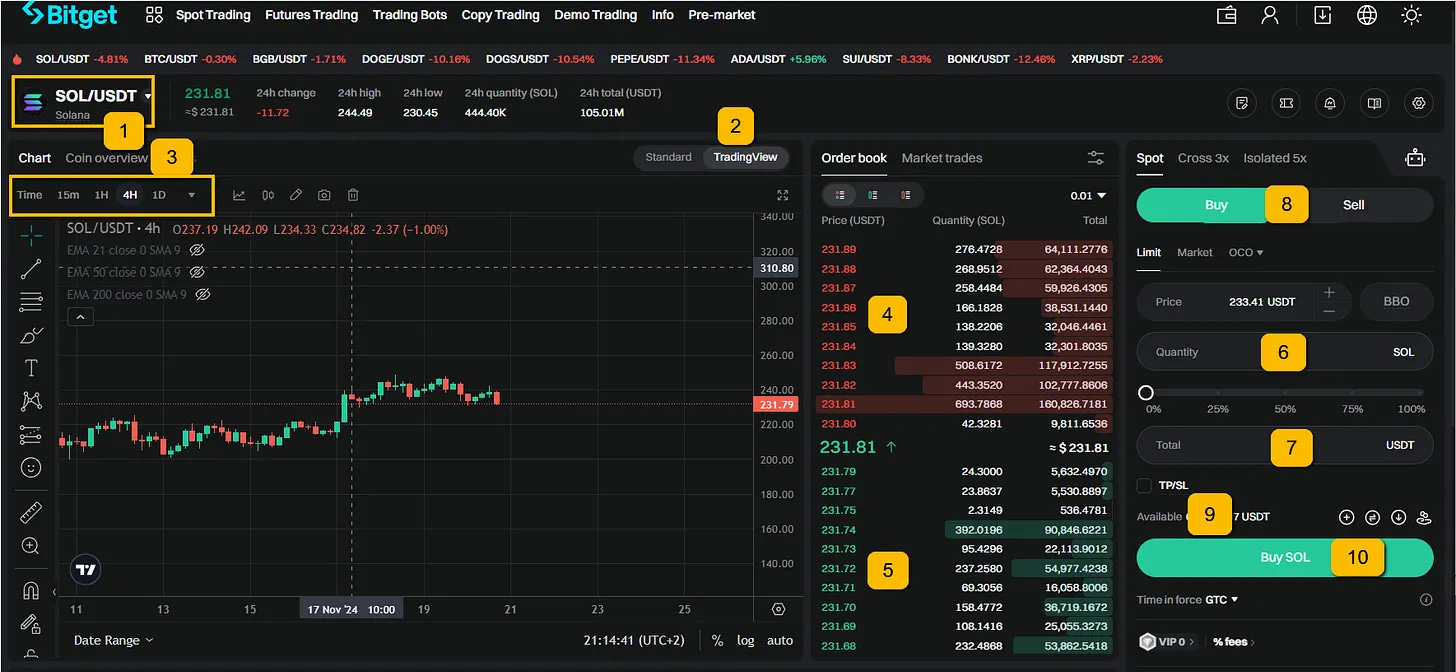

1. The Token You’re Trading: Look for the drop-down arrow to select the token you want to trade.

In this example, you’ve chosen $SOL (the ticker symbol for Solana). Tickers are shorthand names for cryptocurrencies, often preceded by a dollar sign to distinguish them as trading assets.

2. Chart Layout: You can choose between the traditional chart layout or the superior TradingView chart. TradingView provides detailed analysis tools and a cleaner layout for understanding market trends.

3. Timeframe: This determines the period for each candlestick on the chart to close (e.g., 1 minute, 1 hour, 1 day).

4. Order Book (Red Zone): The red prices represent the selling prices—what traders are willing to sell their coins for. It also shows the number of coins available and the total value at each price point.

5. Order Book (Green Zone): The green prices represent the buy orders—what traders are willing to pay for the coin.

6. Number of Coins: Enter the number of coins you want to buy or sell in this field.

7. Total Price: Alternatively, you can input the total amount you wish to spend or earn.

8. Buy or Sell: Choose whether you want to buy or sell the coin. For now, you’ll be buying $SOL.

9. Available Balance: The balance of $USDT (Tether) in your account will be displayed. $USDT is a stablecoin pegged to the US dollar and is the primary currency for buying tokens.

10. Executing the Trade: Once you’ve entered your desired price and quantity, click the buy button to complete your purchase.

At the centre of the order book, you’ll see the current market price displayed prominently.

A Quick Note About Bitcoin

If Bitcoin's current price of $94,448 seems daunting, don’t worry. Like gold, you can purchase fractions of a Bitcoin. Even small investments can grow significantly in a bull run.

Level 4: Spot Trading Like a Pro 🎯

Dive Into Spot Trading

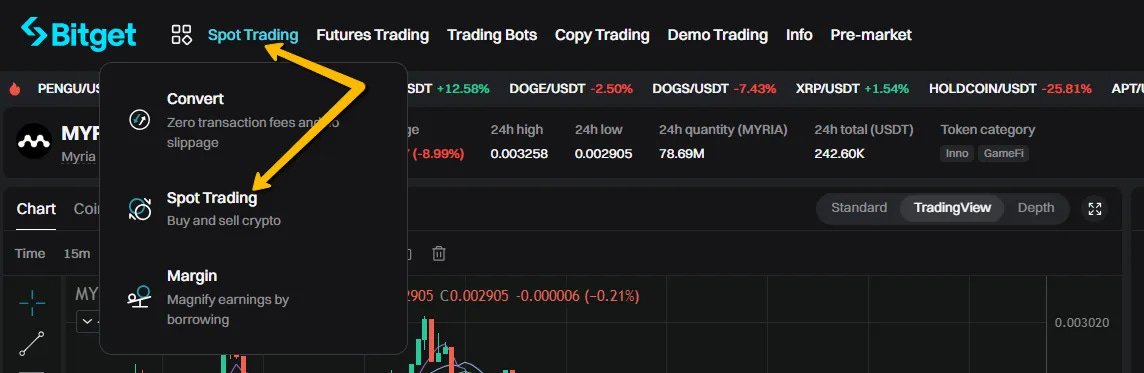

Hit the 'Spot Trading' tab, and voila! You're now in the heart of the action, surrounded by all the crypto pairs you could ever dream of. This section will display all the available trading pairs and their real-time prices.

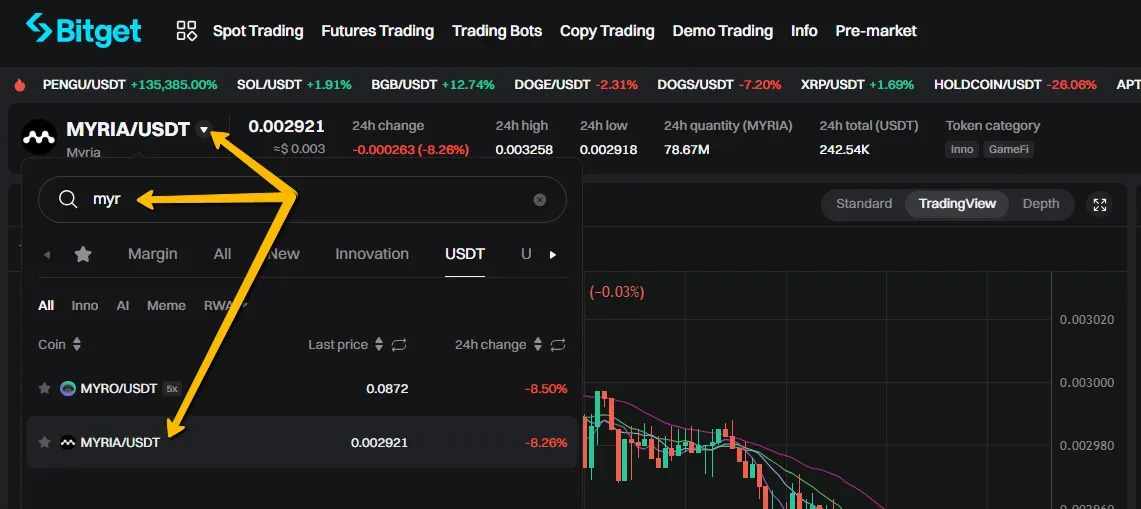

Pick Your Trading Pair

Feel like a kid in a candy store? Choose your favourite crypto pairs - from the mainstream like BTC/USDT to the hidden gems waiting to be discovered. Just hover over the dropdown arrow, click into the search field, and type in the name of your coin.

Our Captain Kyle has dropped some real candy. He is buying Myria, WMT, Altura. Just DCA-ing in slowly. If you join the Whale Room, there is plenty more candy there.

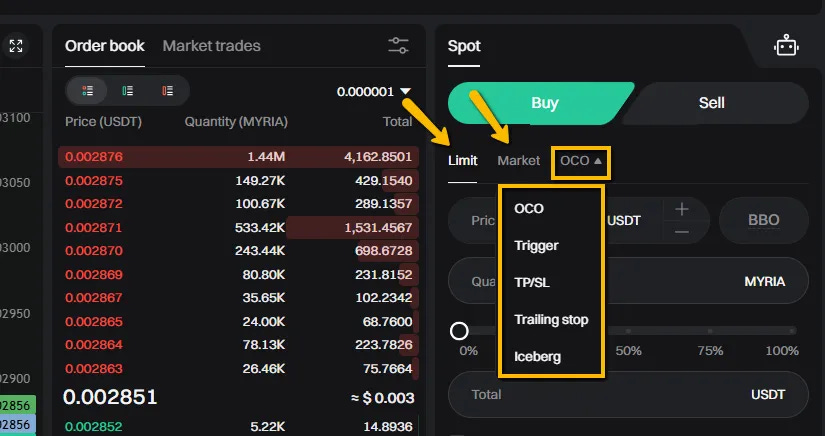

The Order Arsenal

Market Orders

The "I want it NOW" button. If you want to buy or sell immediately at the current market price, use a market order. This is the quickest way to enter or exit a position.

Limit Orders

Your price sniper rifle. For more control over your trading price, place a limit order. Here, you specify the price at which you want to buy or sell. The trade will only execute if the market reaches your set price.

Trigger Orders

Set it and forget it, until the market hits your magic number. These execute when the market hits a particular price, allowing for automated trading based on price movements.

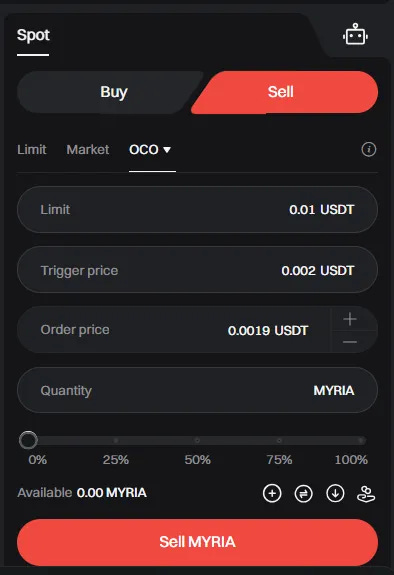

OCO (One-Cancels-the-Other)

The "heads I win, tails I don't lose much" strategy. Place two orders where one cancels the other upon execution. If you want to buy, you have three variables. Suppose you have already bought Myria at say $0.002874. Now you can set an OCO where it sells if it hits your stoploss at 0.0019 or it sells when it hits your take profit level at 0.01. The trigger activates the stoploss if the price goes below it, and it activates the TP if the price stays above it.

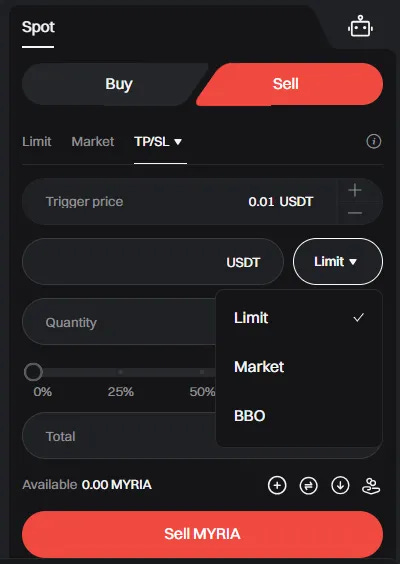

TP/SL (Take Profit/Stop Loss)

Your safety net and profit catcher. Set up automatic orders to manage your profits or cut losses at predefined levels. You can set your desired TP and SL levels for your open spot trading positions. When the market price reaches your set TP level, the order is triggered, and your trade is automatically closed, locking in your profits. Similarly, when the market price reaches your set SL level, the order is triggered, and your trade is automatically closed, limiting your potential losses. By using TP/SL orders, you can automate your trading strategy and manage your risk more effectively.

How do BBO Orders Work?

BBO, or Best Bid Offer, is a specialized type of limit order designed for efficiency in trading. It enables traders to automatically set their order prices based on current market conditions, specifically aligning with the best available prices at the time of order placement. This can lead to faster executions and potentially better price matches.

When placing a BBO order, the price is set according to the selected BBO option:

Counterparty 1:

Buy Order: Set to the lowest current ask price.

Sell Order: Set to the highest current bid price.

Queue 1:

Buy Order: Set to the highest current bid price.

Sell Order: Set to the lowest current ask price.

Counterparty 5:

Buy Order: Set to the 5th lowest current ask price.

Sell Order: Set to the 5th highest current bid price.

Queue 5:

Buy Order: Set to the 5th highest current bid price.

Sell Order: Set to the 5th lowest current ask price.

How is BBO Different from Other Order Types?

Dynamic Pricing: BBO orders dynamically adjust to the best bid or ask price at the time of placement, unlike static limit orders where you set a specific price.

Partial Fulfillment: If only part of your BBO order can be filled at the best price, the remaining quantity stays in the order book at that price, not moving to the next best price, which is different from how market orders handle unfilled portions.

This approach with BBO can offer traders a strategic edge by aligning their orders with the market's liquidity and price at the moment of execution.

Trailing Stop

Keep the profits rolling in by automatically adjusting your stop price as the market moves in your favour, locking in gains while giving your position room to grow.

Pro Tips for Effective Spot Trading on Bitget

Start small, dream big

Stop-losses: Never trade without stop-losses (seriously, they're your best friends)

Security: Always ensure your account's security by using two-factor authentication (2FA) and never sharing your private keys or passwords. Read more about scams on my blog here.

Leverage Margin Trading: For those looking to amplify their trading power, Bitget offers spot margin trading with up to 10x leverage on selected pairs. This can increase potential profits but also comes with higher risks. This will be discussed in a follow-up blog.

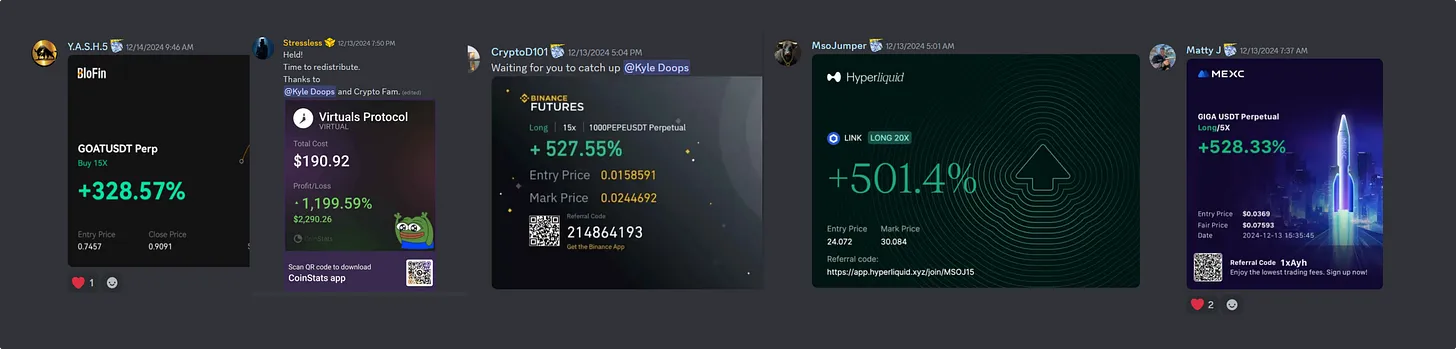

🐋 Swim with the Whales

The latest buzz in The Whale Room is all about Bitcoin soaring and the impending altcoin boom. We're not just observers; we're the ones making the market move. Here’s a glimpse into how our members are riding high:

Christo Columbus navigated a 300% gain with his PRCL Spot entries.

Sea-Scalper Farouk caught a wave with a 559% return on $ONDO.

Josh the Navigator sailed through an FTM leveraged trade for 500% and an ONDO limit order for 560%.

See how our Whale Room community transforms insights into substantial gains.

Our members aren't just trading; they're reshaping their investment paths. Listen to their experiences in The Whale Room:

📈Free Trade from the Whale Room

Hey, crypto crew! Here’s an exclusive trade from Josh the Navigator to act on now:

$KAS - coming into our buy zone like a magnet:

Entry: $0.13515

SL: 0.12345

Conclusion

Spot trading on Bitget is straightforward once you understand the basics. With its user-friendly interface, zero-fee spot trading, and a variety of trading pairs, Bitget stands out as an excellent platform for both beginners and seasoned traders. Remember, while trading can be lucrative, it involves risks. Always trade with caution, only invest what you can afford to lose, and continuously educate yourself on market trends and trading strategies. Happy trading!

Don't just watch the market from the shore. Join The Whale Room today, and become part of the elite who not only catch the wave but ride it out until the perfect moment to cash in.

Help Spread the Word!

If you’d like to help me spread the word, all you have to do is send one friend a personal email where you tell them all about today’s blog.

Follow me on X

Chat soon!

Inet Kemp